Someone recently asked me, "How many subscriptions are needed to achieve the profitability levels that WWE had prior to launching the WWE Network?"

To answer that question, there's three pieces of information to gather:

- What are we calling "pre-WWE Network profitability"?

- What's the conversion from WWE Network subscriptions to WWE profitability?

- Where are WWE Network subscriptions now?

1. Pre-WWE Network Profitability

WWE Financials

| $WWE | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 |

|---|---|---|---|---|---|---|---|---|

| Net Revenues | 485.7 | 526.5 | 475.2 | 477.7 | 483.9 | 484.0 | 508.0 | 542.6 |

| OIBDA | 77.7 | 83.4 | 91.5 | 94.0 | 52.0 | 63.2 | 30.4 | (15.5) |

| Depreciation & Amortization | 9.3 | 13.1 | 14.4 | 11.7 | 15.0 | 20.0 | 24.5 | 26.7 |

| Operating Income | 68.4 | 70.3 | 77.1 | 82.3 | 37.0 | 43.2 | 5.9 | (42.2) |

On February 24, 2014, the WWE Network launched domestically after years of discussion.

Let's go back to the "glory days" for WWE profitability between 2008 and 2010.

While WWE did not publish "OIBDA", we can calculate an adjusted OIBDA (operating income before depreciation & amoritzation) by adding the D&A and OI. From 2008-2010, WWE averaged a little under $90M in adjusted OIBDA.

Therefore, let's set our target, annual pre-WWE Network profitability, at $90M.

Therefore, let's set our target, annual pre-WWE Network profitability, at $90M.

For perspective, the latest guidance from WWE (in the Q3'15 earnings release) was that 2015 would end around $38M to $42M in Operating Income and adjusted OIBDA of $62M to $66M. Essentially, if Q4 goes according to WWE's projections, WWE will be back at the 2012 level of profitability. (Again, that's technically a pre-WWE Network year, though starting in 2011, WWE had already begun investing and spending money on developing what ultimately became the WWE Network.)

That begs the obvious question: what is 2015 average paid subscriber number?

2. Converting WWE Network subscriptions to WWE Profitability metrics

The WWE Network is only a slice of the overall WWE business model. (There's live event revenue, television rights fees, licensing & merchandising revenue, WWE Studios, Digital Media and so on.)

Yet, WWE repeatedly insists that, "The level of WWE Network subscribers is a critical determinant of the Company’s projected

future financial performance."

In fact, look at the "2016 Perspective" in the Third-Quarter 2015 filings:

2016 Perspective

Using Netflix growth as a potential benchmark, management would characterize an annual growth rate of 20% to 25% for WWE Network as very strong performance. If the average paid subscribers to WWE Network increased at a rate within this range in 2016, management currently estimates WWE’s overall revenue could grow approximately 5% - 10% driven primarily by the increase in network subscribers and the escalation of television rights fees. Management currently estimates that this level of revenue growth could result in 2016 Adjusted OIBDA of approximately $90 million to $100 million with no other changes to the Company’s operations.Paraphrased: If WWE can achieve a 20-25% growth on 2015's average paid subscribers number, they would achieve adjusted OIBDA of $90M-$100M in 2016.

That begs the obvious question: what is 2015 average paid subscriber number?

3. WWE Network subscriptions today

WWE Network subscriptions

| qtr ending | paid subscribers | domestic subs. | int'l subs. | qtr avg paid subs. | qtr gross additions | qtr churn | ytd avg paid |

|---|---|---|---|---|---|---|---|

| 9/30/2015 | 1,233,000 | 990,000 | 243,000 | 1,173,000 | 453,000 | (376,000) | 1,106,000 |

| 6/30/2015 | 1,156,100 | 939,300 | 216,800 | 1,215,170 | 337,300 | (508,400) | 1,072,100 |

| 3/31/2015 | 1,327,000 | 1,131,000 | 196,000 | 927,000 | 795,000 | (284,000) | 927,000 |

| 12/31/2014 | 816,000 | 772,000 | 44,000 | 721,000 | 336,000 | (251,000) | 567,000 |

| 9/30/2014 | 731,359 | 702,883 | 28,476 | 723,174 | 286,000 | (255,000) | 514,652 |

| 6/30/2014 | 699,752 | 699,752 | - | 665,000 | 349,000 | (144,000) | 406,000 |

| 3/31/2014 | 495,000 | 495,000 | - | 147,000 | 519,000 | (24,000) | 147,000 |

We know that year-to-date (YTD) through Q3, the average number of paid WWE Network subscriptions in 2015 was 1,106,400. The unknown is how Q4 is going to perform.

Luckily, WWE did provide some guidance on how they believed they would end the year:

WWE's earlier statement was that 20% growth (1.36M) to 25% growth (1.42M) in average paid WWE Network Subscribers would result in $90M to $100M in OIBDA.

2015 Business Outlook

For the fourth quarter 2015, the Company expects ending paid network subscribers of approximately 1.2 million, representing essentially flat results from the third quarter 2015Therefore, let's assume that there is 1,200,000 paid WWE Network subscribers as of December 31, 2015. Assuming that average WWE Network paid subscriptions during Q4'15 was about 1,216,500 (halfway between 1.2M and 1.233M), then the average paid WWE Network subscribers for 2015 would be 1.133M.

WWE's earlier statement was that 20% growth (1.36M) to 25% growth (1.42M) in average paid WWE Network Subscribers would result in $90M to $100M in OIBDA.

The Answer?

This analysis suggests that to achieve pre-WWE Network OIBDA level of about $90M, WWE would need to average about 1,360,000 paid WWE Network subscribers in 2016.Final Thoughts

If we start 2016 at 1.2M paid WWE Network subscribers, that's an increase of less than 14%. In terms of new markets, WWE is now available in India (though subscriber numbers are unlikely to be significant for a variety of reasons) and will be available in Japan and Germany starting in January 2016. Still, questions remains whether WWE can consistently grow subscriber numbers in 2016 in the wake of slumping ratings and a rash of superstar injuries.

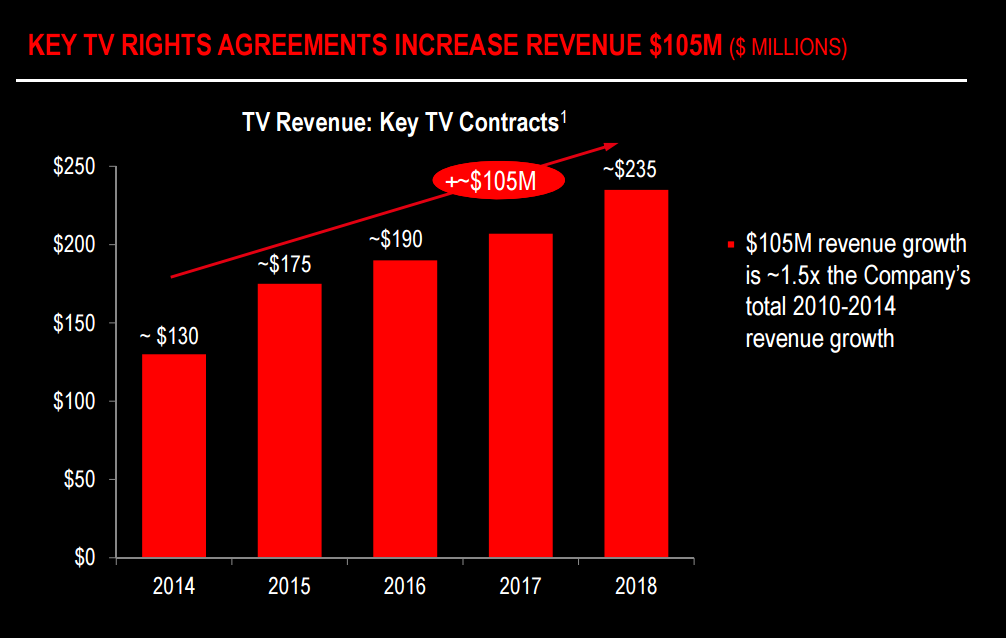

Lastly, WWE's goal isn't to return to pre-WWE Network profitability, but to grossly exceed them. Contractually-obligated WWE Television Rights fees are the engine for WWE's growth.

In 2010, WWE earned $127M in Television Rights and Advertising Fees. From Q4'14 to Q3'15, WWE's Television segment has already earned $226M. That's more than a 75% increase in television rights revenue, and yet 2015 will be about $30M less OIBDA as compared to 2010. The natural escalation of key bundle of television rights for WWE will deliver $15M more in 2016 ($190M) than 2015 ($175M).

The point being that WWE takes in $100M more in Television Revenue and $55M in WWE Network Revenue ($70M PPV in 2010 versus $125M in WWE Network Q4'14-Q3'15) to generate less 30% less OIBDA than five years ago. There's certainly been shifts in other segments (International Live Event revenue is down, licensing is down, magazine publishing division closed, home entertainment continues to slide). In 2010, WWE generated 3.63M PPV buys at $45/non-WM buy. In 2016, they'll need to generate the equivalent of 16.32M WWE Network monthly "buys" at $10/domestic sub (+350% the buys for +130% the revenue).

Analysis and Commentary by Chris Harrington (chris.harrington@gmail.com)