WWE Chief Strategy and Chief Financial Officer George Barrios appeared at the Cowen & Company 43rd Annual Technology, Media & Telecom Conference on May 27 for a forty minute session split between his normal WWE Investor pitch and Q&A from analyst John Blackledge.

(My comments will be italicized.)

Webcast is available at http://wsw.com/webcast/cowen23/wwe/

Moderator Blackledge notes he's a WWE fan. First, it'll be the investor presentation (about 20 minutes). Then about 20 minutes of Q&A with Blackledge.

(Not only is this apples-to-oranges comp- one weekly show versus whole network in Prime Time, but think of how much advertising revenue differ.)

Webcast is available at http://wsw.com/webcast/cowen23/wwe/

Moderator Blackledge notes he's a WWE fan. First, it'll be the investor presentation (about 20 minutes). Then about 20 minutes of Q&A with Blackledge.

WWE INVESTOR PRESENTATION

Barrios begins presenting:

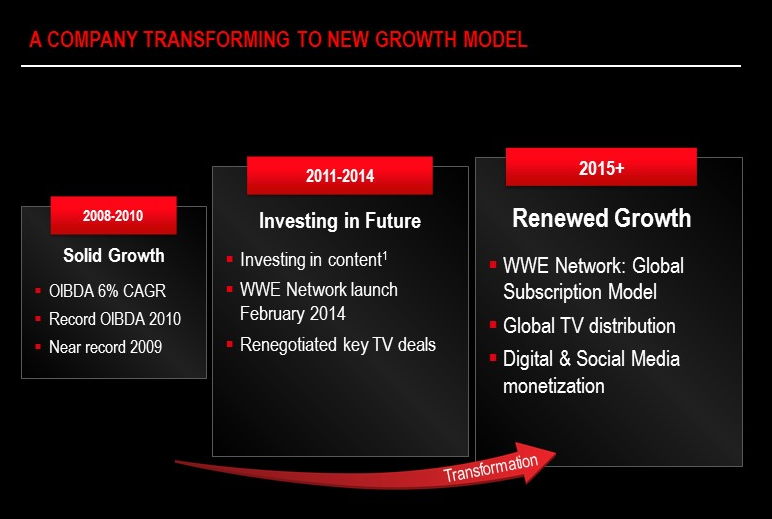

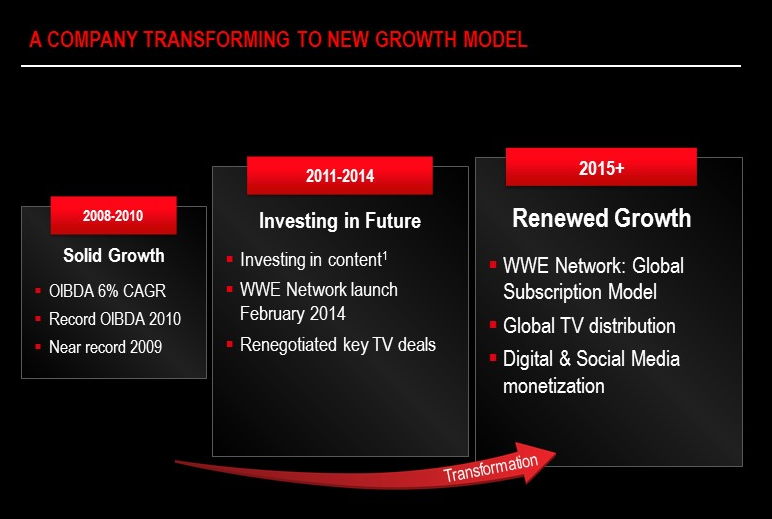

Barrios characterizes the 2011-2014 as "deep investment cycle wrapped around monetizing WWE IP across variety of emerging platforms".

(You'd never survive one of these presentations if you were taking a shot whenever any form of "monetization" was uttered..)

Barrios pitches WWE as "Strong Balance Sheet with Net Cash Position".

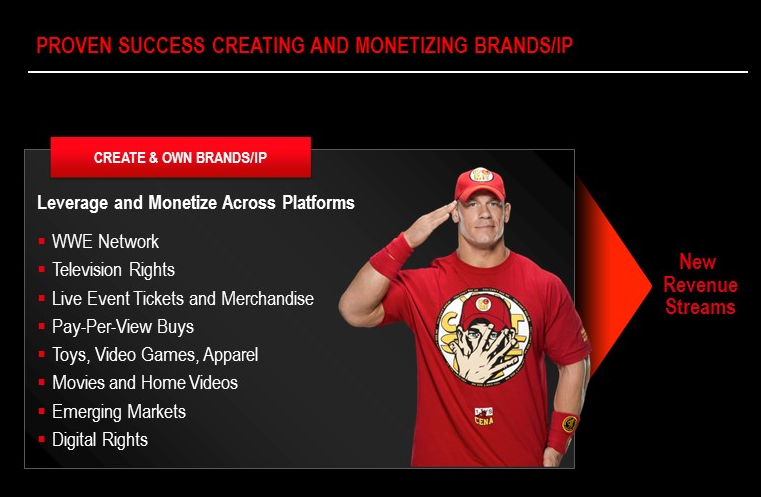

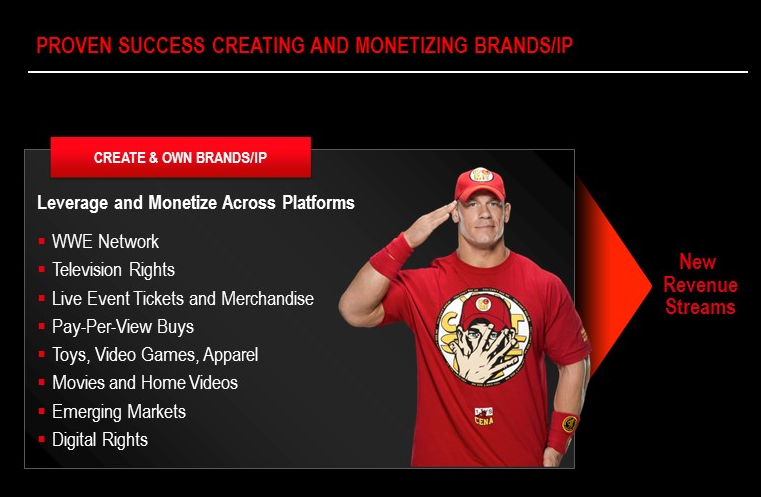

"At 50,000 foot level, WWE fairly traditional media model. It creates intellectual property (shows, superstars/divas) and then monetizes it across a variety of platforms (tickets, toys, t-shirts, video, advertising)."

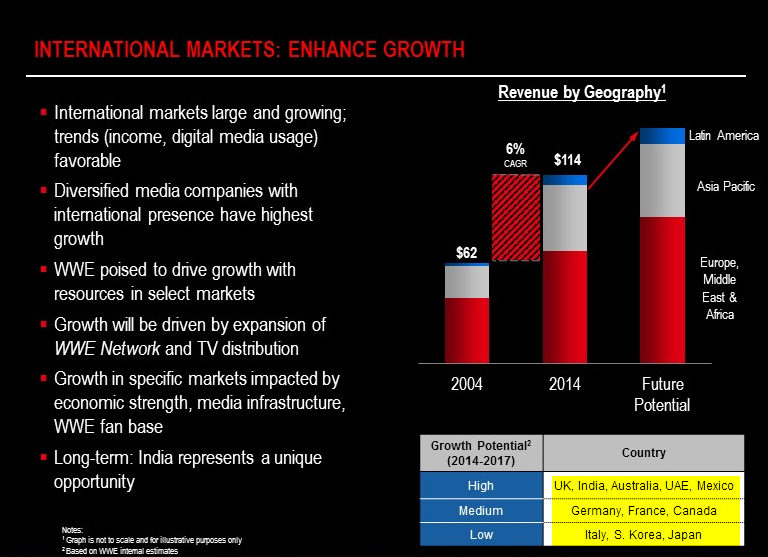

About 25% of the revenue outside of the US. Over the last 10 years, double-digit CAGR over last 10 years (9%). Live Events 5% CAGR. International Markets has almost doubled from 2004 to 2014.

- Quick Overview of the Company

- Key Strengths

- Future: Growth catalysts

Barrios characterizes the 2011-2014 as "deep investment cycle wrapped around monetizing WWE IP across variety of emerging platforms".

(You'd never survive one of these presentations if you were taking a shot whenever any form of "monetization" was uttered..)

Barrios pitches WWE as "Strong Balance Sheet with Net Cash Position".

"At 50,000 foot level, WWE fairly traditional media model. It creates intellectual property (shows, superstars/divas) and then monetizes it across a variety of platforms (tickets, toys, t-shirts, video, advertising)."

About 25% of the revenue outside of the US. Over the last 10 years, double-digit CAGR over last 10 years (9%). Live Events 5% CAGR. International Markets has almost doubled from 2004 to 2014.

- "One of my personal favorites, we just brought our IP to the Flintstones."

- "WWE Immortals taking our IP to more of a 'superhero vein'."

(He's also fond of comparing the new Seth Green project to "South Park".)

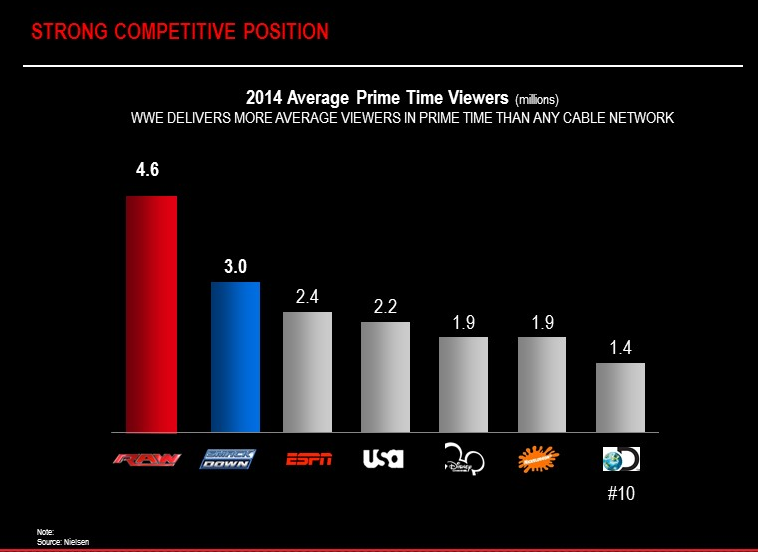

(You need to read the small print to figure out how WWE is claiming to beat Game of Thrones, Duck Dynasty and Walking Dead in viewership.)

(Not only is this apples-to-oranges comp- one weekly show versus whole network in Prime Time, but think of how much advertising revenue differ.)

Barrios brags the #WWENetwork has subscriber(s) in Timor-Leste. He even offers "all of the money" in his pocket to anyone who knows where Timor-Leste is!

- "What makes us unique- we own 100% of our content. We license it out, but no back-end."

- "We have an expertise around creating live content."

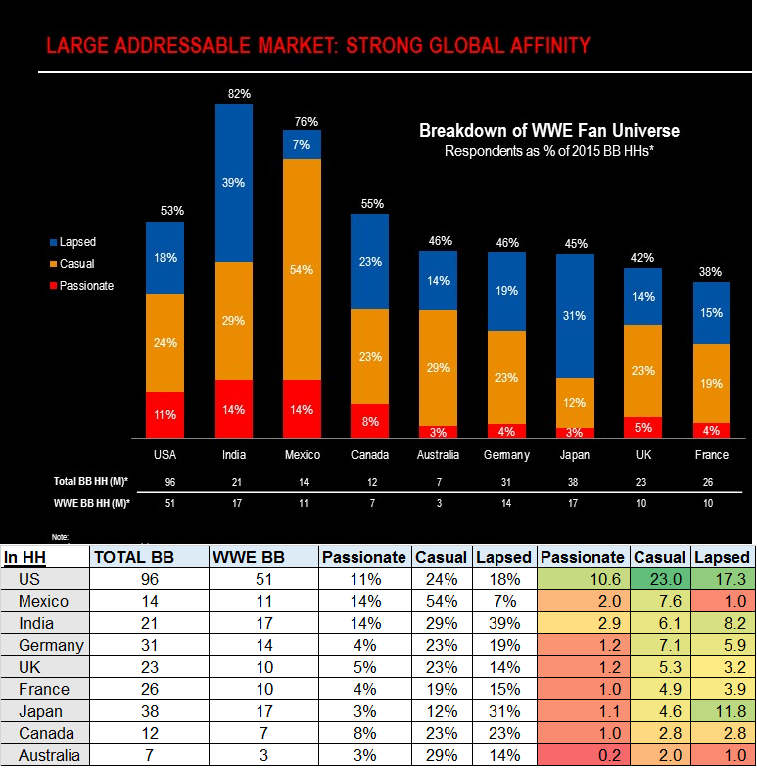

The "LARGE ADDRESSABLE MARKET" pitch:

- 311M broadband homes in WWE's top 16 broadband global markets.

- About half of them have someone in the home with some affinity for WWE content.

- About 60M are lapsed fans. 100M are active. 25% passionate, 75% more casual fans.

(Interesting to see the large number of lapsed fans in Japan. Also, the WWE Network hasn't officially launched in either Japan, India or Germany yet.)

Discussing the infamous affinity studies... (see also https://sites.google.com/site/chrisharrington/wwe_marketsize )

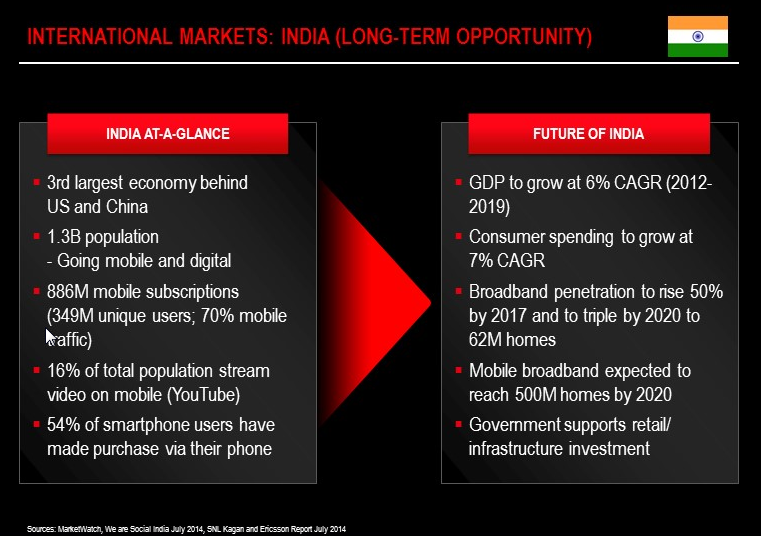

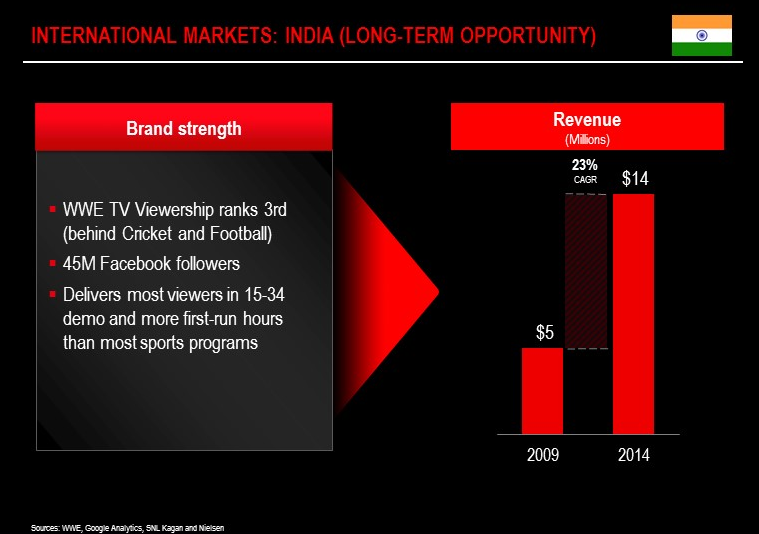

India is our third largest market. The top three are US, UK and India. Sweet spot for WWE is 18-34 males. Yet, WWE has a "very diverse audience."

(This is higher percentage of female audience than 2012-2014 claims which were more in the 33%-35% range. Brandon Howard notes that FB analytics tells a different story - closer to 25%. Scott Walters did suggest that some of this could be stigma about "liking" wrestling, which is a valid point. I believe WWE looks at unique HHs who want several minutes of any programming throughout the whole year including all of the replays, which are obviously much more plentiful on E! for Total Divas.)

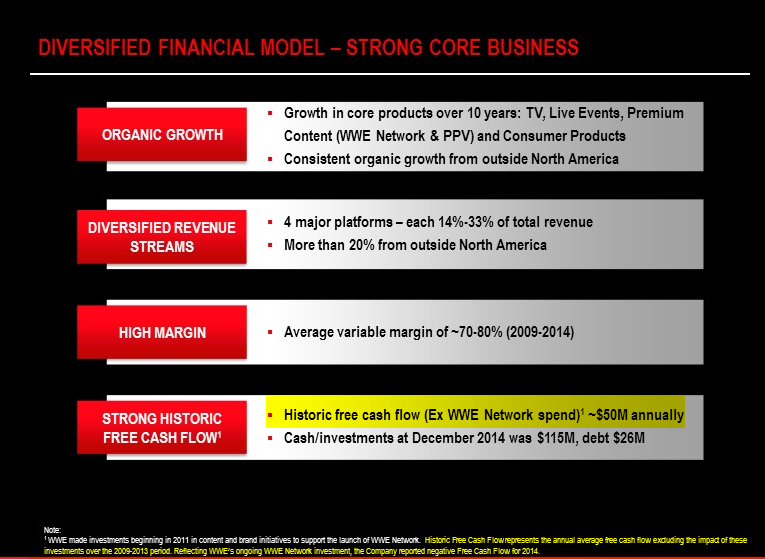

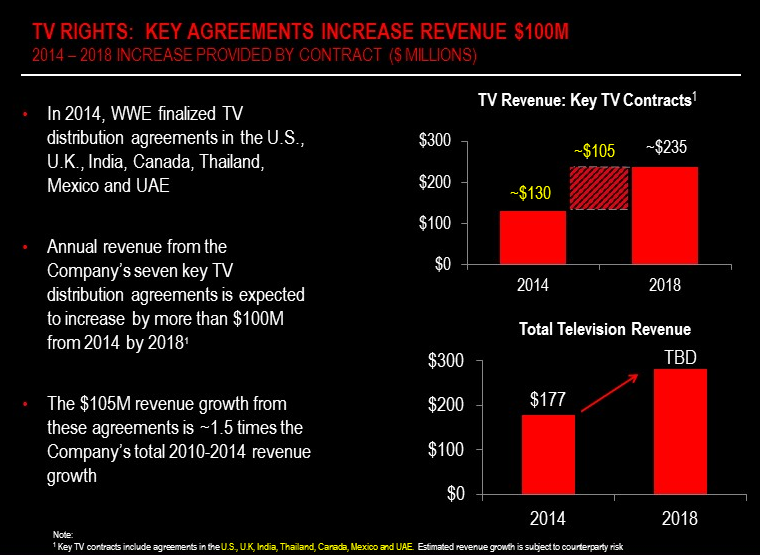

(It'll be interesting by Q2 to get a feel for much of that incremental $105M we're going to see in 2015 alone.)

(Worth calling out the footnote noting admitting that 2014 had "negative cash flow" and also that WWE recently took a $50M pre-payment from a TV partner for cash.)

While speaking about the WWE Network, Barrios notes that Jerry Springer's "Too Hot for TV" program is not programming into the 24/7 linear stream and only available via on-demand.

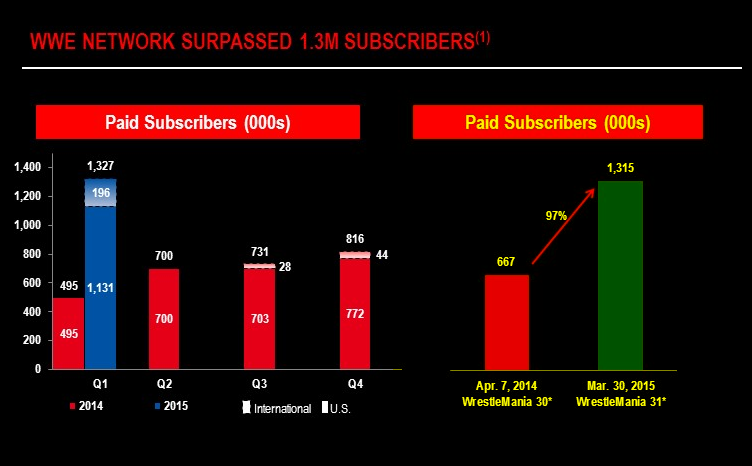

(Impressive 97% growth in paid subs. However, the drop in profitability that 2014-2015 WrestleMania generates versus the 2009-2013 WrestleMania is also stunning.)

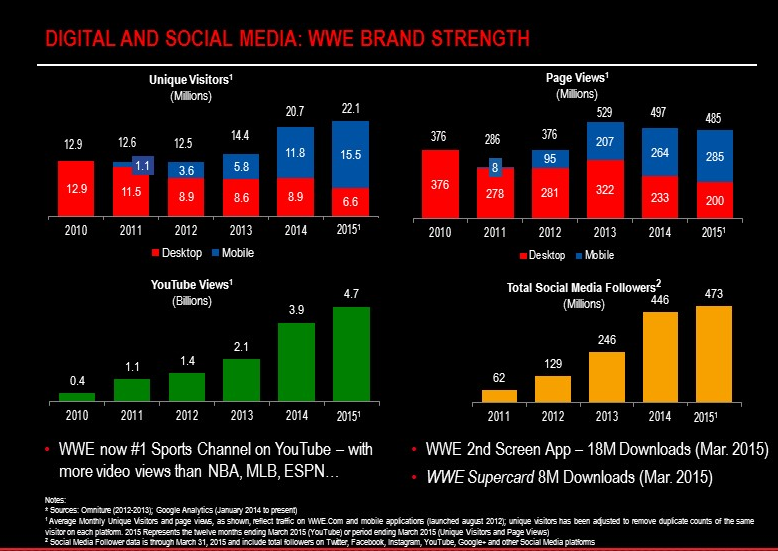

- "We spend a lot of time internally, all layers of mgmt engaging & expanding our social footprint. 2010-2011 was the internal clarion call."

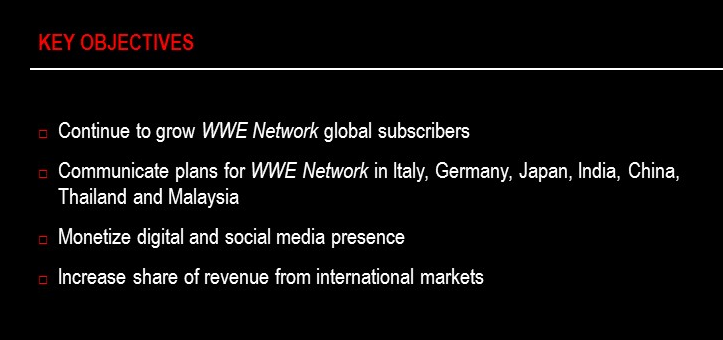

Where WWE has identified for greatest potential international growth: UK, India, Australia, the UAE and Mexico.

Regarding India...

The $14M that India generated in 2014 was solely from TV rights and that is before the latest deal began. India is WWE's 3rd largest int'l market solely off TV rights. There was "infinitesimal Consumer products" revenue.

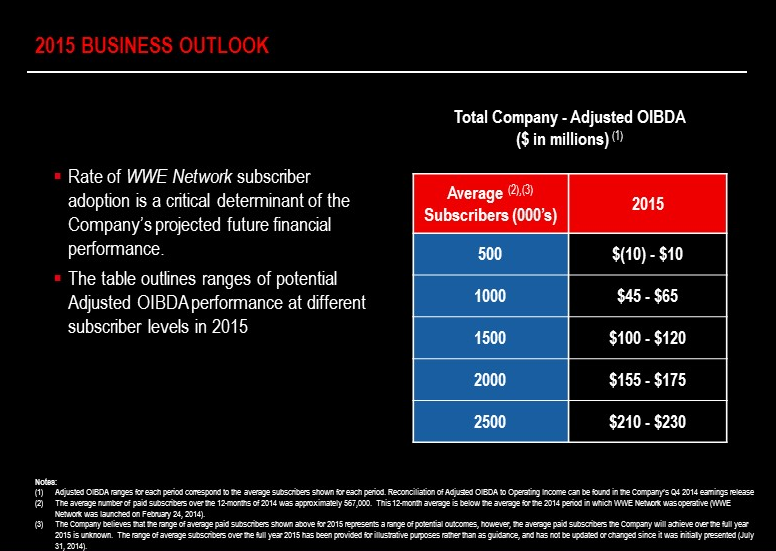

WWE FUTURE GUIDANCE

WWE Network is the guiding variable. Barrios did promise to "tighten that range up on a quarterly basis."

WWE SCORECARD

Regarding new international WWE Network markets, Barrios said plans would be communicated in "12 to 24 months".

Q&A TIME

Q: On the Network side, how do you feel and management feel about the value proposition? You have PPVs including WrestleMania and the vast library of content. Current thoughts on value proposition?A: I think it's phenomenal but I'm pretty close to it. Bill Simmons wrote a review, "All this for $9.99? I feel like I'm stealing money from Vince McMahon." We had a "million and change" PPV homes. We're trying to get to 3 to 4 million homes. It's about the Elasticity from bringing price down.

Look at Netflix. Started with 17M DVD homes and goal set was 60-90 SVOD homes by lowering the price and giving customers almost infinite content. The value proposition we're thrilled with.

Q: The Pricing - if we look at pricing, Netflix is about $8-$9/month US irrespective of market. That's the same price even though what consumers pay for TV may vary greatly. Will that work for markets like China and India?

A: What we've done with the WWE Network is make the US product available around the world. There's been very little localiziation. Why? We thought we'd benefit from learning. Over time, we'll see if it makes sense to localize in those markets and which markets.

Localization can have three have layers:

- Marketing

- Pricing

- Content.

Q: What are some particular learnings you've had from Netflix?

A: We learn from Netflix all of the time. Internally, there's those of us who have read every single public document from them both from a conceptual & opportunity level.

- "We are very happy to take other people's ideas and make them our own."

Q: Let's discussing unpacking the content. You have about 3,000 hours available on the WWE Network versus the 130,000 hours of content that WWE has in their library. How do you unpack the content?

A: Right now, we'll add anywhere between 400-1,000 hours this year. One of the internal questions will be, is that enough? Should we speed that up? That will become our internal operations and how quickly we can move that. The value of bringing it in more slowly and promote it. Themed promotions around new content and make it seem more special bringing it in. There's definitely a long-tail to the way that the content gets viewed. A smaller piece of the content is always viewed by someone. Of the fifty hours, we're probably alike on the 10 hours of PPV. The other 40 hours are different. That is the long-tail of digital distribution.

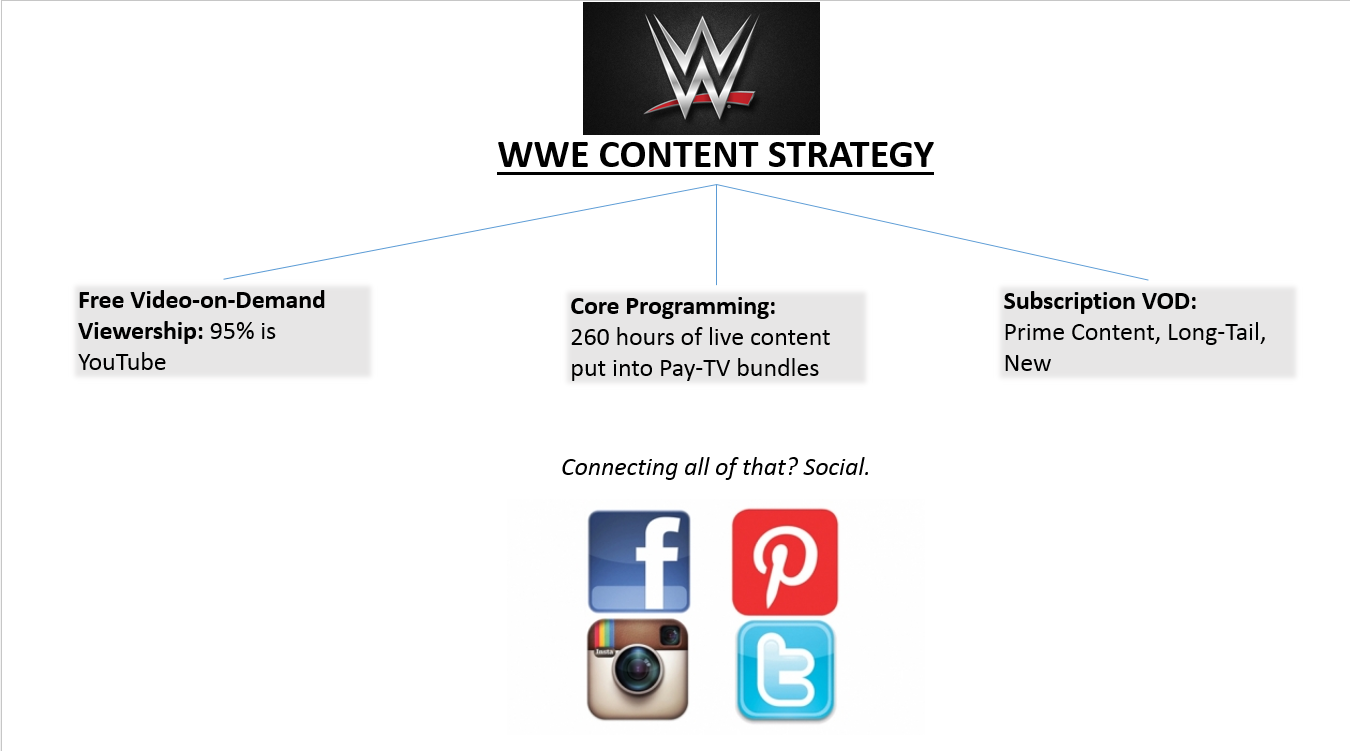

Q: How do you feel you're monetizing your YouTube views?

A: It's monetized through advertising and revenue share. That business has gone from hundreds of thousands of dollars to millions. The monetization has grown about 10x which is great and that's terrific.

That's the way we view content. It's a balancing act. It's an internal debate about which content goes where. Today, this is our strategy. YouTube is important to us from a monetary standpoint and important from a ubiquitous and engagement standpoint.

Q: I want to touch on innovation. There's been a lot of innovation at the company. It was a strong move going over-the-top with the WWE Network. Touch on innovation and where you feel there's been innovation. Also data. How you use data to inform investment in content?

A: On the innovation side, we're doing more things in any part of business than before.

New content using our IP (Scooby Doo), new games (Immortal, Supercard), testing out at new ways to merchandise at live events where you can order from your device and pick it up to avoid the long lines. These initiatives are "singles" and "doubles". We think over time they will add up. The WWE Network was singularly the biggest innovation that we've done. There's been a lot of innovation between 2011-2014. As our deals were being renewed, we wanted to take advantage of that.

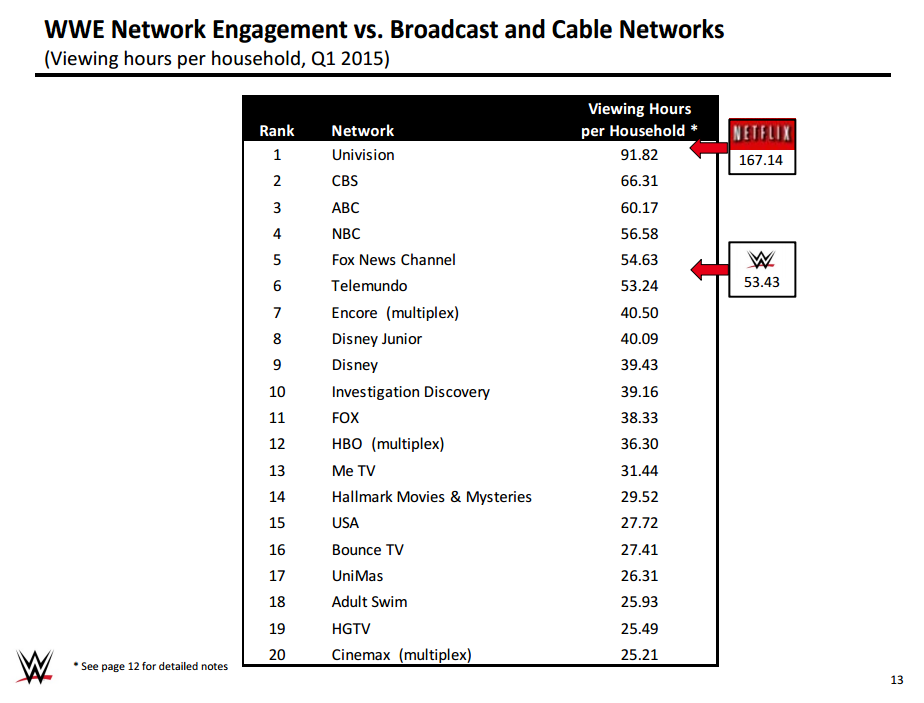

On the data side, I'm not going to make news today. When we see what's being viewed on the Network, internally people are stunned. At the amount of consumption of content that intuitively would been consuming. 55 hours on average with only 10 hours of our PPV content. 85% of the consumption was other content. No one would have intuitively thought that.; People who would

have lived & breathed the brand their whole lives were stunned. The big push would be to link the disparate accounts that we have: e-commerce, ticketing, social side. It's easier said that done.

That ability to make the customer at the center of our ecosystem and really personalize. We're one year in to our Big Data. We're fast followers. We've hired our first five data scientists. We see that as an opportunity over time. The programming data we get on the Network informs the network. The biggest opportunity is the cross-pollination of data across the different data sets that we have.

Q: You have made a big push into development. The development center in Florida. How do you view the roster? How does the developmental center lead to the results?

A: 3-4 years ago, we were discussing about investing in our talent development side. You would look at the investment and see that it wasn't a high priority by the spend. It's changed under Paul Levesque's leadership. It's a step-change on how we're grooming our Raw & SmackDown talent. Roman Reigns, Dean Ambrose, Bray Wyatt are becoming one of our most popular superstars. Go to event and get a feeling for who our fans are. Go to Orlando and see the development center and the future.

Q: As you talk about international push, it'll become increasingly important over time. You have a big audience in China & India. Is it important to have a popular Chinese or Indian character?

A: I don't think it's one or the other. John Cena is iconic and popular around the world. He's the most followed US athlete - 75% follower are from outside of the US. He has more followers than Kobe. Does Wade Barrett resonate a little bit more in the UK? Sure. How about Great Khali in India? Rey Mysterio in Mexico? Sure. There's no doubt there is a certain amount of ethnocentrism to it.

How do you balance that and give everyone a little time? We've got a lot of people around the world who like what we do. It's a good problem for us.

(I've tried by best to summarize Barrios' comments. In some cases, I have paraphrased the dialogue or even left out portions of the conversation. To fully appreciate and understand, you are encouraged to listen to the webcast yourself.)

Chris Harrington

chris.harrington@gmail.com